Oct 2016

Flow-Through Shares for Canada's Innovation Sector?

What is to be done for Canada’s innovation sector when our banks are the most risk averse in the OECD, our venture capitalists venture little and the angels live abroad? How do we fund new technologies and the enterprises to develop and commercialise those technologies when Canada’s financial sector is still tied to asset-heavy 20th century industry? Ironically, the solution may well lie in the past—with asset-heavy 20th century industry.

Flow-through shares were developed as a means of attracting investment for the natural resources industries—mining and oil & gas—with their high up-front equipment costs and distant profit horizons. Essentially, flow-through shares allow resource companies to convert future losses into current capital by transferring (flowing through) the tax deduction for those losses from the companies to their shareholders and so enabling those companies to issue their shares at a premium. Tomorrow’s losses are thereby converted into cash today. Recognising that the value to investors lies not in the security that the equipment represents but in the loss created by the equipment’s cost, the same model could be applied to help technology companies that lack the assets to obtain secured financing.

Technology companies must lobby for change if they are to access this flow-through share strategy, so long available to Canada’s natural resources sector—and, more recently, the renewable energy sector. Certainly, if Canada is to look forward instead of backward and transition from a natural resources to an innovation economy, the rules respecting flow-through shares must be expanded.

So what, then, are flow-through shares exactly and how do they work?

Nature of Flow-Through Shares

A flow-through share is a common share to which certain contractual rights attach. These rights obligate the company to renounce (flow through) qualifying expenses to the share subscriber, which expenses cannot exceed the particular subscriber’s subscription amount. The subscriber may then deduct those qualifying expenses for income tax purposes.

The reference here is specifically to “subscriber” rather than “shareholder” because flow-through rights are contractual and do not, therefore, inhere in the shares themselves. If, therefore, a flow-through share is sold, the flow-through rights do not pass to the purchaser but remain with the subscriber.

The Benefits

As stated above, flow-through shares allow a company to obtain a premium upon issuance since the subscriber will be able to deduct the company’s qualifying expenses. For a young technology company with few or no assets to offer as security and little or no cash-flow history, such expenses may be all it has to trade on. And, so long as those expenses are incurred, investors get the tax deduction regardless of whether the company ever earns a profit. So, investors enjoy the same potential upside that they otherwise would if the company becomes profitable, but their downside is subject to a floor in the amount of the tax benefit. As shown below, investor risk is thereby reduced by more than half.

The Numbers

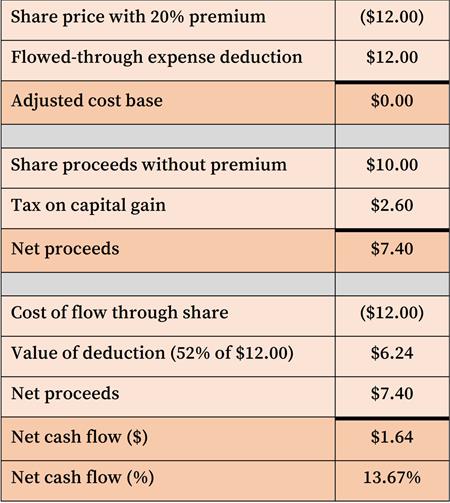

Assuming the combined Federal and Ontario top marginal tax rate applicable to individuals in 2016, the value of a flow-through share to a subscriber is 52% of the subscription price plus the future growth on the underlying common share. Such accrued value is realised upon a subsequent share sale and, provided that the shares are held as capital property rather than inventory, only half the sale proceeds are taxable. The cash flow may be illustrated as follows:

If, therefore, an investor were to subscribe at a price of $12.00 per share and subsequently sell for $10.00 then, assuming current top marginal tax rates, that investor would realise a 13.67% rate of return notwithstanding what would otherwise be a 16.67% loss. And if the company were to fail and its shares become unmarketable, investors would still be entitled to the deduction of $6.24, reducing the risk of loss by 52%.

The Timing

The general rule is that the qualifying expenses must be incurred within two years following the end of the month in which the flow through shares were issued. However, to make these shares more attractive to investors, there is a further rule which provides that the full two years of expenses can be renounced in the first year if certain conditions are met. Briefly stated, cash consideration must have been paid for the shares in the first year, the subscriber and the company must deal at arm’s length throughout the second year and the expenses must be renounced in the first quarter of the second year. Necessarily then, the subscription agreement will include the company’s covenants to spend all subscription amounts upon the qualifying expenses by the end of the second year, failing which the company will indemnify the subscriber from the consequent tax penalty.

Conclusion

Flow-through shares could present a significant opportunity for Canada’s innovation sector if the Federal government could be persuaded to make flow-through shares available to technology companies. The ability to trade future expenses for current investment has been a boon to Canada’s natural resource economy and could remove the current roadblock to technology companies who lack the assets to obtain traditional secured financing.